Learn everything you need to know about buying a home.

I am an education based Loan Officer. Please read through the articles below to help you learn more about the home buying process.

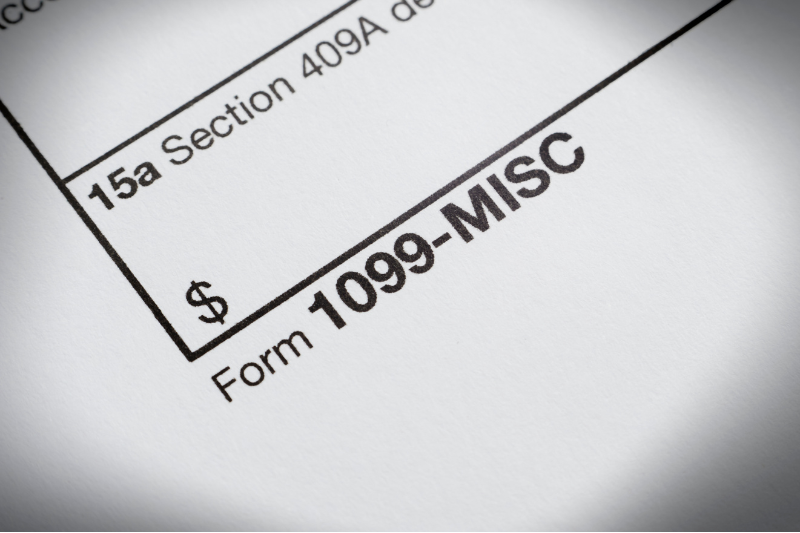

Self-Employed and Ready to Buy a Home? Here’s How Lenders Judge Your Hustle

So you’ve been out here grinding. LLC in the bio. Invoices flying. Taxes paid (hopefully). And now you’re ready to…

Before You Buy a House: Let’s Talk Upfront Fees (a.k.a. the “Not-So-Free” Part of Homebuying)

Look—buying a house in Texas is exciting. But just like that $20 you thought you’d spend at Target turning into…

W-2 to 1099? Don’t Let That Job Switch Wreck Your Home Loan Dreams

So you’re out here trying to secure the bag and the house. Respect. Maybe your job offered you a switch…

🚨 Don’t Let Zelle Fumble Your Keys: Preparing A Bank Account 3 Months Before Buying a Home

You ever been this close to your dream house—already picturing the grill in the backyard, neighbors peeking at your fresh…

When Do Mortgage Documents Expire?

Because Yes, Lenders Are That Picky…You’ve gathered your paystubs, bank statements, and credit reports like a champion. You’re ready to…

Down Payment vs. Closing Costs: What’s the Difference & How Much Do You Really Need?

So, you’re gearing up to buy a home in the Houston suburbs—maybe in Katy, Sugar Land, The Woodlands, Cypress, Richmond,…

Special Purpose Credit Programs (SPCP) Cancelled: What This Means for Your Mortgage Rate and Down Payment

If you’re gearing up to buy a home in Katy, Sugar Land, The Woodlands, Cypress, Richmond, Spring, Tomball, Fulshear, or…

Navigating the FHA’s New Residency Requirements: What Houston Suburb Homebuyers Need to Know

Hello, future homeowners of Katy, Sugar Land, The Woodlands, Cypress, Richmond, Spring, Tomball, Fulshear, and beyond! If you’re dreaming of…

FHA Appraisal Changes in 2025: What Houston Suburb Homebuyers Need to Know

If you’re looking to buy a home in Katy, Sugar Land, The Woodlands, Richmond, Pearland, Fulshear, or Cypress, you may…

Child Support & Home Loans: What Every Houston-Area Buyer Needs to Know

Buying a home in Katy, Sugar Land, The Woodlands, Cypress, Richmond, Fulshear, Pearland, or anywhere in the Houston suburbs? You’ve…

Preparing to Buy a Home in Any Houston Suburb in Summer 2025

☀️ Summer 2025 is right around the corner, and you’re dreaming of backyard BBQs in your new home. But before…

Jerome Powell’s March 2025 Speech Decoded: What It Means for Mortgage Rates in Katy, Texas

On March 19, 2025, Federal Reserve Chairman Jerome Powell stepped up to the mic, and while he didn’t directly say,…

Should You Buy a House With March 2025 Interest Rates?

Or should you wait and hope the housing market stops playing hard to get? As the flowers bloom and pollen…

Why Commission, Tip, and Bonus Income Might Not Count for a Mortgage Qualification

So, you’ve been killing it at work—racking up commissions, stacking up tips, or cashing in on hefty bonuses. You’re making…

Say Goodbye to Medical Debt on Credit Reports: What It Means for Your Mortgage in 2025

Imagine waking up on March 17, 2025, to find your credit score has magically increased. 🍀 No, it’s not the…

VA Joint Loans: How Veterans and Non-Veterans Can Team Up for Homeownership

So, you’re a veteran (first, THANK YOU for your service! 🇺🇸), and you want to buy a house. But maybe…

Buying a House: Are You In or Just Browsing Zillow for Fun?

Let’s be real—deciding to buy a house is a big deal. But here’s the thing: you actually have to decide…

Don’t Wait Until the Last Minute to Get Prequalified—Unless You Like Stress Sweats

Picture this: It’s Friday afternoon, and you just found your dream home. You’re already imagining yourself lounging on the back…

Alternative Loans: Why Listening is Your Superpower in Real Estate Financing

So, you’ve decided to dive into the world of real estate investing, and you’re looking for a loan that doesn’t…

Why Are Homeowners Insurance Rates Rising in Houston?

In 2025, homeowners in the Houston, Texas and surrounding areas (Sugary Land, Pearland, The Woodlands, Katy, Richmond, Cypress, Spring) are…

Fix and Flip Loans: Turning Ugly Houses into Profitable Investments

So, you’ve been watching a little too much HGTV and think you’ve got what it takes to flip a house?…

Why You Can’t Qualify for a $1,500 Mortgage—Even Though You’re Paying $2,500 in Rent

If you’ve ever tried to get a mortgage and been denied despite paying rent that’s way higher than the mortgage…

Why You Shouldn’t Apply for a Mortgage While Repairing Your Credit

So, you’re in the middle of credit repair and feeling optimistic about your financial future—great! But before you sprint toward…

Physician Loan: A Prescription for Homeownership Without the Financial Headache

So, you’ve spent years buried in textbooks, surviving sleepless nights, and racking up enough student loans to make your bank…

DSCR Loans: The Ultimate Financing Hack for Real Estate Investors

Are you a real estate investor tired of jumping through hoops to secure financing? Have you used a hard money…

2024 New Loan Limit by the Federal Housing Finance Agency

Exciting news for those dreaming of buying a home! The Federal Housing Finance Agency (FHFA) has recently increased its loan…

Fannie Mae Special Purpose Credit Program for First-Time Homebuyers

The allure of homeownership beckons to many, but for first-time homebuyers, the path to achieving this dream can often seem…

Creative Ways to Save for Your Home in Texas

Welcome to the thriving Texas housing market! Whether you’re eyeing a cozy home in Austin, a spacious residence in Dallas,…

Timing Your Texas Home Purchase: Navigating the Predicted 2024 Housing Shift

Are you thinking about buying a house in Texas but feeling overwhelmed by fluctuating prices and interest rates? You’re not…

The Impact of Part-Time Real Estate Professionals

Relocating to Texas, with its appealing cities like Austin, Fort Worth, Spring, The Woodlands, or Sugar Land, is an adventure…

Understanding Property Taxes for New Builds in Texas

So, you’re thinking about buying a new home in Austin, Dallas, or Houston—three of Texas’s hottest housing markets? Great choice!…

Should I Buy A House With November 2023 Interest Rates?

As you cozy up inside during the chilly November weather, you might be wondering if now is a good time…

Stop Unwanted Spam Calls and Emails When Applying For Mortgages

Are you tired of endless spam calls and emails cluttering your day, especially after applying for a mortgage? You’re not…

Federal Reserve Mortgage Rates News November 2023

Are you currently navigating the housing market and finding yourself grappling with the recent hike in mortgage rates? You’re not…

Freddie Mac Selling Guide Updates on Income, Timeshares, and Appraisals

Are you dreaming of owning a house? Navigating the mortgage process can be like planning a big party — you…

Biden-Harris Administration Homeownership #ReverseTheCurse

The American dream of homeownership has long been a beacon for many families. Owning a home is not just about…

How Economic News Releases And Mortgage Rates

When it comes to understanding the world of mortgages, one might wonder how factors like government announcements and economic news…

Down Payment Assistance in Houston, Texas: A Swift Overview

Are you contemplating buying a home in Houston, Texas, but the hefty down payment is giving you second thoughts? Enter…

Bank Activity During Mortgage Approvals

Ready to unlock the doors to your dream home in Texas? Dive in to discover the game-changing secret behind smooth…

Buying a Home During a Recession: A Smart Move or a Risky Bet?

Recessions can be daunting. Economic downturns, job losses, and market instability might make the idea of buying a home seem…

Cash-Out Refinance in Texas Explained

The real estate landscape in Texas has undergone significant changes over the years, providing homeowners with new opportunities to tap…

Managing Bank Accounts When Buying a Home in Texas

Purchasing a home is one of the most significant financial decisions you’ll make in your lifetime. Knowing how to manage…

How Long Does It Take to Buy a House?

Buying a house is a significant milestone in anyone’s life. But how long does it actually take? Many myths and…

Order The Appraisal Before The Survey

Ordering an appraisal before a survey is a smart practice in real estate transactions, ensuring a clear understanding of a…

Homebuying During Hurricane Season in Texas

Hurricane season can have a significant influence on the home buying process in Texas. Its impact can vary depending on…

How Title Companies Delay Closings

Title companies play a critical role in ensuring smooth real estate closings. However, closings can face delays for various reasons.…

How Appraisers Delay Closings

Appraisers play a crucial role in determining the value of a property during the homebuying process. While their primary responsibility…

How Realtors Delay Closings

Realtors typically do not have direct control over the loan closing process, as this primarily involves the lender, the buyer,…

How Loan Officers Delay Closings

When it comes to securing a mortgage, timely closing is crucial for both homebuyers and sellers. However, some loan officers…

2 Identical Sales Prices With 2 Different Payments?

The amount you pay each month for your new home can vary widely, and it’s not just about the house…

Saving for a House When Mortgage Rates Are High

When mortgage interest rates are high, saving money for a home can seem tough. But with smart planning, you can…

The Federal Reserves Affects Mortgage Rates

When you’re looking to buy a house and get a mortgage, the interest rate you’ll pay on that loan isn’t…

Lowering Your Interest Rate When Buying A Home

An important aspect of buying a home is securing a favorable interest rate on your mortgage. In an unpredictable market,…

Buying A House While Getting Married

Embarking on the momentous endeavors of purchasing a house and celebrating a marriage marks an exhilarating chapter in life. The…

Buying a House During Divorce

Divorce can bring big changes, including the idea of buying a new home. While it might feel overwhelming, with some…

How Can I Estimate My Monthly Payment?

When you’re a first-time homebuyer in Texas, it’s essential to have a clear understanding of how to estimate your monthly…

Moving Money During Mortgage Approvals

Getting a mortgage is a big step towards owning a home. To get approved, you need to show you’re financially…

Someone Else’s Name on Your Bank Statements?

There’s an often overlooked detail that can unexpectedly hinder your mortgage approval process: finding someone else’s name on your bank…

How To Save Money For Your 2024 Home Purchase

Embarking on the journey to homeownership in 2024 requires adopting a savvy savings plan that’s both actionable and forward-thinking. Here…

Your Guide to Preparing Your Credit for a 2024 Home Purchase

Are you holding off on purchasing until 2024? Whether it’s a trendy urban loft or a peaceful suburban retreat, strategic…

How Student Loans Affect Mortgage Approvals

Owning a home is a major life goal, but the road to mortgage approval can be complex. One crucial aspect…

How Rate Hikes Affect Monthly Payments and Approval Amounts

As we approach the last quarter of the year, homebuyers are faced with an impending rate hike that could impact…

Never Use Cash for Earnest Money Deposits

Securing your dream home and finalizing the deal requires making an earnest money deposit. While cash or money orders might…

Why Accuracy Matters on Your Mortgage Application

When it comes to applying for a mortgage, accuracy is paramount. One critical detail that often gets overlooked is the…

Should I Buy a House?

As you make the decision to buy a house, timing, rates, finances, and home prices play important roles in your…

Navigating Homeownership During Economic Shifts

Hey there, future homeowner! As you set your sights on Houston’s vibrant housing market going into into 2024, understanding how…

Buying A Home in 2023-2024 School Year in Houston

As the 2023-2024 school year commences in Houston, parents face unique challenges when buying a home. Balancing their children’s educational…

Best Time to Buy in Texas Summer 2023

Buying a home is a significant decision, and timing can play a crucial role in ensuring a successful purchase. If…

Buying a House Without A Spouse in Texas

If you are legally married in Texas and you want to buy a house without involving your spouse, there are…

How Your Credit Score Affects Your Rate?

Your credit score can have a significant impact on the interest rate you receive when buying a home. As a…

How Much for That Refinance?

With mortgage interest rates being higher than 2020 and 2021 levels, some home buyers are opting to purchase now and…

Will Mortgage Rates Return to Normal Levels?

Many homeowners and prospective buyers are eagerly awaiting a return to “normal” mortgage rates. However, mortgage rates are influenced by…

What Impacts Interest Rates?

Mortgage interest rates affect your monthly payments which impact the affordability of homeownership. Below are the factors that influence mortgage…

Why Closing at The End of The Month Saves Money

When buying a home, one often overlooked aspect is the impact of daily interest charges and how they affect your…

Federal Reserve Freezing Rate Hikes

While the Fed’s decision to freeze rate hikes can provide significant benefits to home buyers, it’s essential for buyers to…

Why You Need A Home Inspection

It’s easy to get caught up in the excitement of finding your dream home, but it’s important not to overlook…

Interest Rates And Payments

Higher interest rates mean higher borrowing costs, resulting in increased monthly payments and potentially impacting your ability to qualify for…

Temporary Rate Buydown Explained

A 3-2-1 temporary rate buydown is a financing option that allows borrowers to reduce their initial mortgage interest rate for…

Applying for a Mortgage with IRS Debt

What happens when you owe money to the Internal Revenue Service (IRS) and you’re applying for a mortgage? With the…

How Higher Interest Rates Affect Monthly Mortgage Payments

An increase in interest rates can have a significant impact on your monthly mortgage payments. Increased Monthly Payments: Higher interest…

Get Pre-Approved Before Making an Offer

When you’re buying a home, it’s crucial to get pre-approved for a mortgage BEFORE making an offer. Pre-approval provides you…

1099 Loans

1099 loans are typically used for independent contractors or freelancers who get 1099s at the end of the year and…

Bank Statement Loans

Bank statement loans are typically used for individuals who have difficulty documenting their income using traditional methods. These loans are…

Can You Get a Mortgage While Working for a Staffing Agency? Here’s What You Need to Know!

So, you’ve been crushing it at your job through a staffing agency, getting steady paychecks, and now you’re ready to…

Closing Costs vs Down Payment for (FHA, VA, and Conv)

Understanding the difference between closing costs and down payment and how they vary between VA, FHA, and conventional loans can…

Renting vs Buying Revisited

When you rent a home, you typically pay a monthly rent to your landlord. You’re not responsible for property taxes,…

Can You Use Multiple Job Incomes to Qualify for a Mortgage? Here’s the Deal

So, you’ve got two jobs, three side hustles, and maybe a lemonade stand on the weekends—and you’re thinking, “This has…

Counting Multiple Job Incomes on a Mortgage Application

When applying for a mortgage, lenders typically evaluate a borrower’s ability to repay the loan based on their income and…

What’s included in my FHA Mortgage Payment?

An FHA loan is a type of mortgage that is insured by the Federal Housing Administration (FHA). This type of…

Credit Repair and Mortgages

If you’re in the process of repairing your credit, you may be tempted to apply for a mortgage. After all,…

Bank Deposits and Transfers During Mortgage Approvals

Managing your bank deposits and transfers is crucial when getting approved for a mortgage loan. Underwriters, review your financial history…

Am I Paying Points for that Rate?

Discount points are upfront fees a borrower can pay to a lender in exchange for a lower interest rate on…

Why did my gift funds requirement increase?

If you are using gift funds for a down payment on a home purchase and the requirement for gift funds…

Can I Be a “First-Time” Homebuyer If I Already Owned a Home?

Many people assume they’re not eligible for first-time homebuyer incentives because they have owned property in the past. This is…

What is an option fee?

Buying a home can be a complex process, and there are several fees and costs involved that potential home buyers…

What is an Earnest Money Deposit?

When purchasing a property, an earnest money deposit (EMD) is a common requirement that buyers should be aware of. This…

Property Taxes in Houston, Texas

As a homeowner in Houston, Texas, it’s essential to understand the various components of your property taxes. These taxes are…

How can I lower my DTI?

Lowering your debt-to-income (DTI) ratio isn’t just a good idea—it’s the financial equivalent of eating your vegetables. It may not…

A Step-by-Step Guide to Shopping for a New Home

Whether this is your first or tenth home purchase, shopping for a new home is an exciting time. It can…

First-Time Homebuyer’s Checklist

Ready to purchase your first home? Use this easy-to-follow checklist to navigate the path to home ownership. Determine Your Budget:…

Understanding Cash to Close

If you have received your Closing Disclosure from your lender, you are almost done with your home buying journey. The…

How to Get Prequalified for a Mortgage

Before you begin your new home search, talk to a lender about getting preapproved (prequalified in Texas) for a mortgage.…

5 Strategies to Save for a Home

Buying a home is a big purchase, one that takes time to save up to afford. Many homebuyers use a…

Expenses First Time Home Buyers Need to Save For

If you are getting ready to purchase your first home, there are a few expenses that you need to prepare…

Finding the Right Location to Buy a Home

They say that buying a home is all about location, location, location. But what if you do not know what…

Should I Buy or Rent?

The biggest question those considering homeownership need to answer is simple: Should I buy or rent my home? Here is…

Understanding an Appraisal Contingency

When buying a new home, you have the chance to put in a number of contingencies to the purchase contract…

How Much Income Do I Need to Buy a House?

Homeownership is not just for the ultra wealthy. While income is an important factor when buying a house, knowing exactly…

Popular Loans for Buying a Home

Finding a great deal on your home purchase requires that you understand the different types of home loans available. Here…

What You Need to Know About Cosigning a Mortgage

If your credit, debt, or income is keeping you from buying a house, you may be tempted to have another…

How to Buy a House with No Money Down

Do you dream of homeownership but can’t come up with the required down payment? Don’t worry. You may be eligible…

Do I Need a Realtor to Buy a House?

When you are ready to make a new home purchase, the first thing to consider is who you want on…

How Much Do I Need for a House Down Payment?

One of the first hurdles that potential homeowners must overcome is saving up a down payment. It can take years,…

A Home Appraisal Checklist

Searching for and finding the perfect new home is just one step of the home buying process. Once you find…

What Is an FHA Mortgage Insurance Premium?

FHA mortgages are great for homebuyers without a sizable down payment or with low credit. Each situation is unique and…

A Home Inspection Checklist

When purchasing a home, it is always a good idea to have it professionally inspected. Many lenders even require it…

What to Look for in a Neighborhood When Buying a House

Evaluating a potential new home’s features is just one part of finding the perfect place to buy. You should also…

Buydown to Reduce Your Mortgage Interest Rate

If you are buying a home, you have probably looked at all kinds of ways to reduce your monthly mortgage…

Buying a House without a Real Estate Agent

Working with a real estate agent can be very helpful when purchasing a house, especially if you are a first-time…

How to Determine if You Are in a Buyer’s Market or Seller’s Market

Being a savvy real estate buyer or seller requires that you know and understand the market conditions. This includes the…

How Long Does It Take to Buy a House?

The home buying process is exciting but can be lengthy, especially if you have a purchase fall through and have…

How to Get Your House Ready to Sell

You’ve mastered the process of home buying, but are you ready to be a seller when it’s time to move…

Negotiating a House Price as a Buyer

Buying or selling a home often comes with some negotiation. In fact, it is expected and normal for both parties…

What Is the Average Down Payment for a Home?

One of the biggest obstacles to homeownership is saving for a down payment. The amount you put down can impact…

How to Know When You Should Buy a House

Do you enthusiastically pore over home listings on online platforms in your spare time? Is driving around looking for For…

What are your goals?